Market Pulse: Q2 2025 Small Business Transaction Trends

What U.S. Data Tells Us About Canadian M&A Right Now

Based on BizBuySell’s Q2 2025 Insight Report - the largest small business for sale marketplace in the U.S.

A Snapshot of the U.S. Market

BizBuySell’s data is American, but it still offers valuable insight for those of us buying and selling small businesses in Canada. The trends are often similar - just on a different scale.

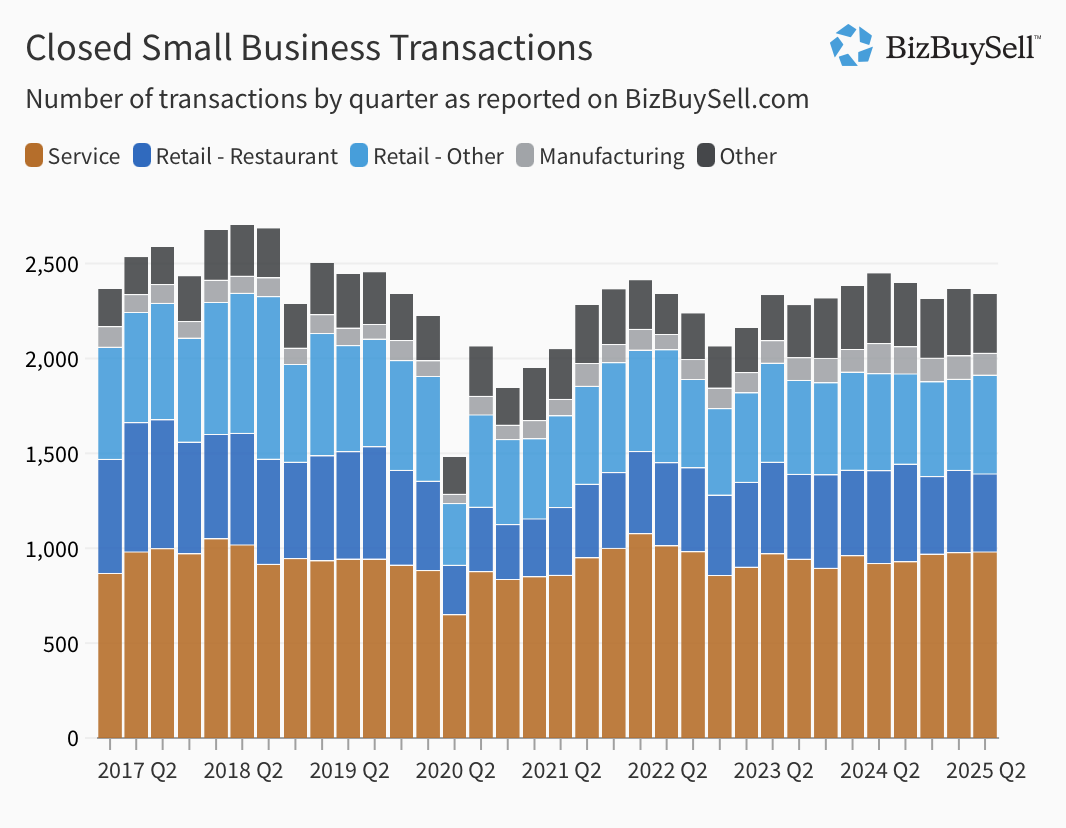

Deal Volume Dips Slightly

U.S. small business sales dipped 4% year-over-year in Q2 2025, with just over 2,300 deals closed.

While Q1 was relatively strong, the recent softening is linked to macroeconomic uncertainty (ie. tariff wars), shifting interest rate expectations, and changes in lending programs (the US government-back SBA loan program, which funds most deals, is tightening regulations). Overall, deal volume has yet to rebound to pre-COVID levels.

Despite that, there’s no sign of a crash - just more caution from both buyers and sellers.

Seller & Buyer Sentiment

As of a January 2025 survey, sellers and buyers remain confident and hopeful:

90% of sellers believe conditions will stay the same or improve through 2025

95% of buyers say they’re optimistic about the current market

Growth in the business-for-sale market looks steady but uneven, with some industries clearly pulling ahead. In a choppy economy with tighter credit and slower momentum, buyers are leaning toward businesses with steady demand and predictable costs.

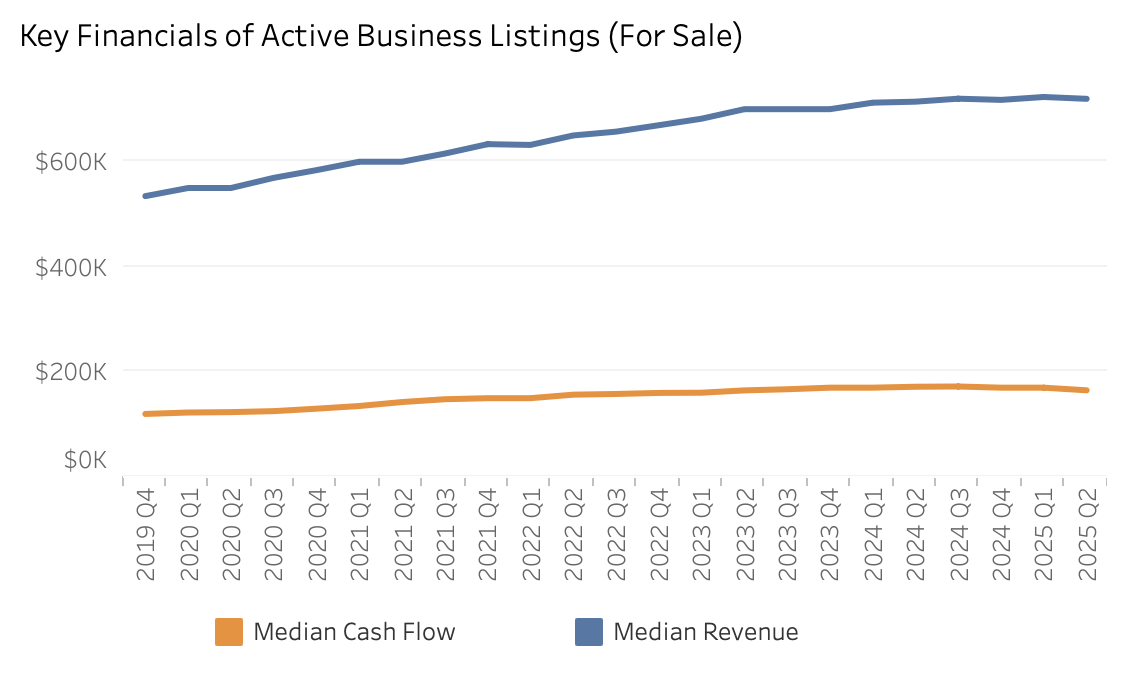

Overall, small business revenue and earnings have recovered steadily from 2019, but appear to have plateaued / declined slightly at the end of 2024 and in the first half of 2025.

*Data provided by BizBuySell.

What’s Selling (and What’s Not)

The most attractive businesses right now? Boring, profitable, and essential - especially trades, B2B services, distribution, and certain sectors of retail. Buyers are seeking businesses that are:

Simple to operate

Financially clean

Resilient to economic cycles (73% are looking for this in 2025)

Meanwhile, businesses relying on international trade, big capital requirements, or with inflation-sensitive costs/revenue are facing more scrutiny. Manufacturing (down 28%) and restaurant (down 16%) businesses, in particular, are feeling the strain, with median cash flow and revenue both declining.

Valuation Benchmarks

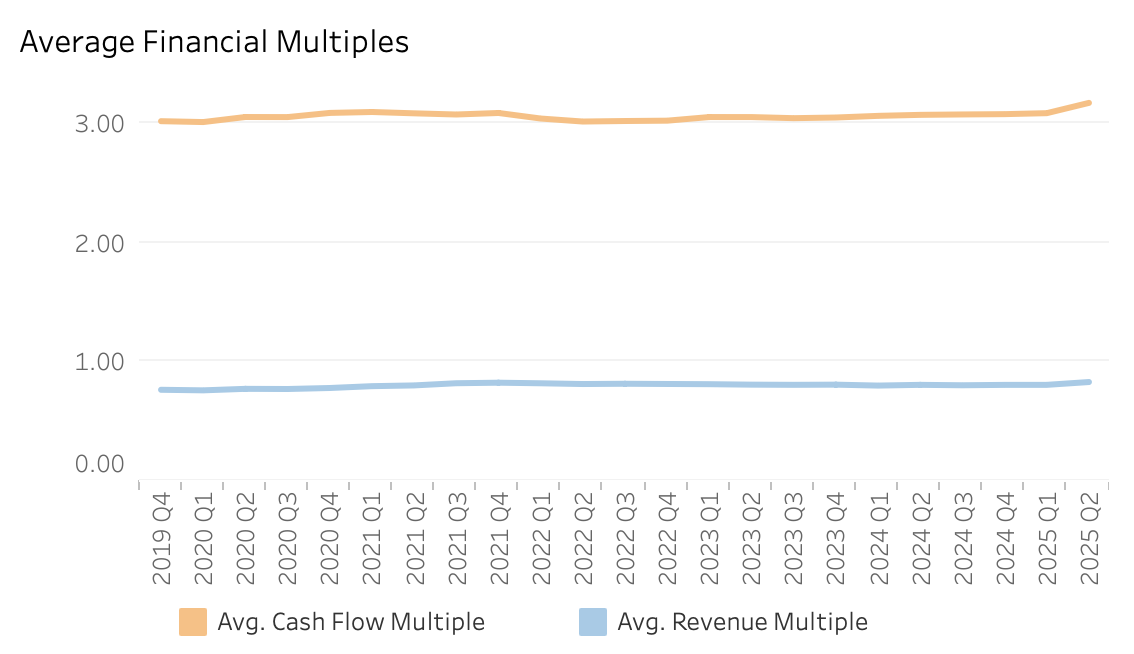

In Q2 2025, median price multiples for U.S. small businesses were:

Price-to-Revenue: ~0.83x

Price-to-Seller’s Discretionary Earnings (SDE): ~3.17x

What does this tell us? Well, not much. Multiples can vary significantly by industry and due to the characteristics of individual businesses. But overall, multiples have remained relatively steady, and have crept up slightly since 2019.

In my experience, these figures are generally consistent with Canadian “main street” and lower mid-market businesses. I’ll probably do a deep-dive into industry-specific multiples in the coming weeks.

*Data provided by BizBuySell.

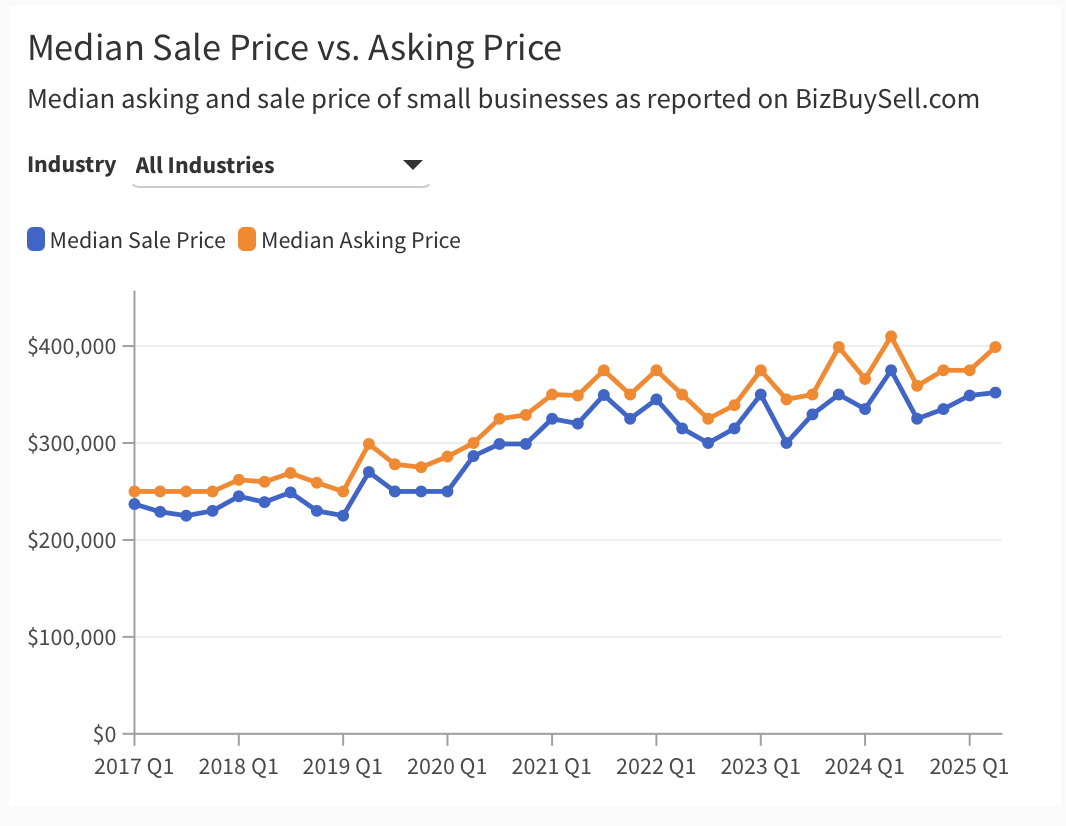

Asking vs. Selling Prices

The gap between asking prices and selling prices grew in Q2 2025. Whether this is a trend or an anomaly remains to be seen.

Median asking price: ~$399,000

Median sale price: ~$352,000

The $50K gap (approx. 12% of asking price) is essentially at its highest point since 2017, and shows that buyers are negotiating harder, and deals are getting done at more realistic valuations.

*Data provided by BizBuySell.

🇨🇦 Canadian Takeaways

While our banks and taxes differ, many of the fundamentals apply in Canada:

2.5×–3.5× SDE remains a typical multiple for profitable businesses

Owner-reliant businesses are tougher to sell

Traditional lenders are still reluctant to fund “goodwill-heavy” deals

Tariff-related pressures related to US trade are a concern

Inflation is still a problem in certain industries

Clean books and a smooth transition plan make a big difference

Tips for Buyers

It’s still a good time to buy - but buyers need to be realistic, prepared, and strategic. A few key tips:

Stick with stability: In today’s economy, favour businesses with recurring revenue, steady demand, and manageable costs.

Line up financing early: With lenders tightening up, it’s smart to have your funding (or at least your plan) in place before signing an LOI.

Expect to contribute equity: Most lenders want to see at least 20% down. If that’s a stretch, consider bringing in a partner or negotiating a vendor note to make up the difference.

No lowballs: Sellers may be motivated, but they are patient and expect fair value. A thoughtful, well-structured offer goes further than a steep discount.

In short: boring is beautiful, preparation is power, and collaboration wins.

Tips for Sellers

If you’re thinking of selling:

Get your financials normalized (if you’re not familiar, read about Seller’s Discretionary Earnings here)

Figure out what your business is worth. Use real comps, not guesses. Industry-specific data will help you price properly.

Don’t wait for perfect timing. Be ready before you need to sell.

Final Thoughts

Finding Canada-specific data is tricky, but information from our neighbours south of the border is a great proxy and can help set expectations. The current market is still active - just picky.

Good businesses will sell. Especially when the numbers make sense.

Need Help?

Thinking of buying a business? Or curious what your business might be worth?

Book a 1-Hour Deal Review or engage me for an Opinion of Value.

Disclaimer: I am (thankfully) not a lawyer, nor am I an accountant. If any of this sounds like legal/financial advice, it's not. Take everything I say with a grain of salt. But not too much - I hear it's bad for your blood pressure.